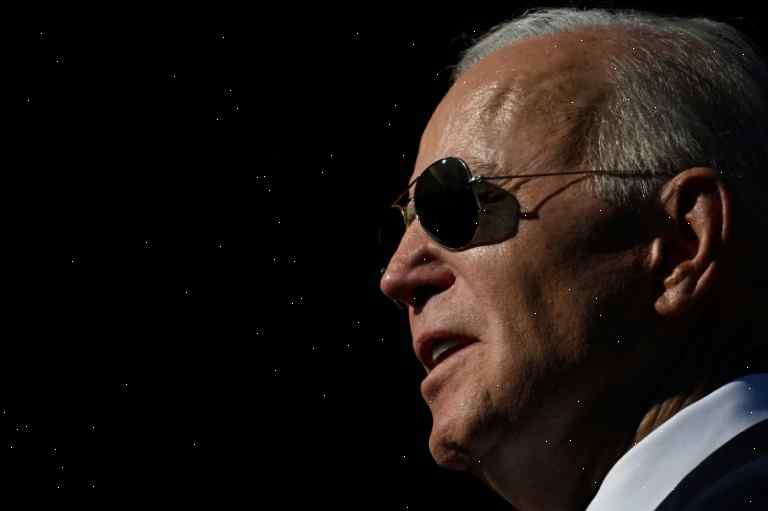

Asian markets showed promising growth today, buoyed by positive sentiments surrounding US President Joe Biden’s impending visit to the Middle East. The trip, aimed at fostering global cooperation and addressing pressing regional issues, has generated optimism among investors and business leaders.

In Japan, the Nikkei 225 index rose by 1.2%, driven by advances in tech stocks such as Sony Corp. and Toyota Motor Corp. South Korea’s Kospi Index followed suit, climbing 1.5% on the back of strong performances by Samsung Electronics Co. Ltd. and Hyundai Motor Group.

China’s Shanghai Composite Index also saw a significant increase, surging 2.3% due to improved investor sentiment towards the country’s economic prospects. Hong Kong’s Hang Seng Index joined the uptrend, rising 1.8% amid renewed interest in technology and finance shares.

The rally in Asian equities was further fueled by favorable economic indicators. Japan’s exports recorded their highest growth rate in three months, while China’s foreign trade figures showed resilience despite lingering pandemic concerns. Investors remain hopeful about the potential benefits of increased international collaboration, particularly in light of the recently signed Regional Comprehensive Economic Partnership (RCEP).

President Biden’s visit comes at a critical time, as tensions in the region have been escalating due to geopolitical conflicts and trade disputes. His agenda includes meetings with leaders from various countries, focusing on topics such as energy security, counterterrorism efforts, and human rights. Analysts believe that successful negotiations could pave the way for enhanced stability and prosperity across the Middle East and Asia.

While market observers acknowledge potential risks associated with the trip, they generally share a bullish outlook for the short term. With the US Federal Reserve maintaining its accommodative monetary policy stance, coupled with improving fundamentals in the region, many expect the upward trend in Asian markets to persist.

In related news, oil prices edged higher ahead of the OPEC meeting next week, where producers may discuss output cuts to stabilize global crude supplies. This development has had a positive impact on energy stocks, contributing to the overall performance of Asian markets.

As traders look forward to the rest of the week, attention will shift to the release of key economic data, including China’s inflation numbers and the US jobs report. These statistics hold the potential to influence market dynamics and shape investment strategies moving forward.

In conclusion, the anticipation surrounding President Biden’s visit to the Middle East has injected confidence into Asian markets, driving them higher today. Buoyant investor sentiment, underpinned by encouraging economic indicators, suggests continued growth momentum in the days ahead.